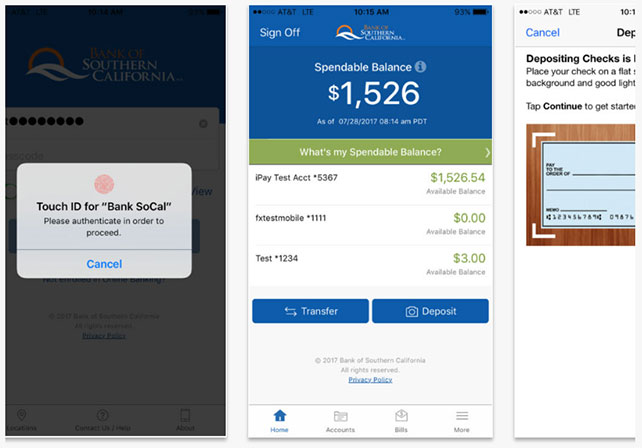

One of the perks of being a member of Bank of Southern California is the ability to use our online and mobile banking features. With both online and mobile banking, you receive 24/7 access to your accounts and the ability to perform a variety of banking transactions anytime, anywhere. We do not charge a monthly fee or per account charges unlike most major banks, which makes your banking always accessible and easier.

For business online and mobile banking, there are quite a few daily activity transactions, cash management, and business administration features. First, we provide daily activity transactions features where you can:

- View your account activity, balances, and transaction history in real-time

- Transfer between accounts

- View check images and statements

- Set up bill payments for one-time and recurring payments

- Schedule balance alerts and e-mail notifications of transactions to be approved

- Place stop payments

Our cash management features are not available in mobile banking; however, the cash management features in online banking include:

- Initiate and track all ACH payments and collections

- Export and sync transaction history to Quicken, QuickBooks, Excel, and Microsoft OFX

- Initiate domestic and international wires

Lastly, the business administration features include:

- Administrative rights to set up user accounts for employees

- Assign customized permissions to each individual user

- Track online employee transactions

- Use dual authority for any type of debit transaction

For personal online and mobile banking, we offer you all the same daily activity transactions features as our business online and mobile banking. Most if not all your banking needs can be done without ever stepping foot into the bank!

If you are already a customer of ours and wish to enroll in online banking, click here and then select “Personal Enroll.” If you would like to go mobile as well, you can download our app in the App Store or Google Play. We are always here to answer your online and mobile banking questions, so please contact us.