Presented by Glenn Carniello, CPA CCIFP – Partner at Eide Bailly

The Employee Retention Credit (ERC) is a refundable credit that businesses can claim on qualified wages, including certain health insurance costs, paid to employees. Most employers, including colleges, universities, hospitals and 501(c) organizations following the enactment of the American Rescue Plan Act (ARPA), can qualify for the credit.

Under the ARPA and previously under the Consolidated Appropriations Act (CAA) 2021, the ERC was extended and expanded. It can be claimed through Dec. 31, 2021, by eligible employers who retained employees during the COVID-19 pandemic. This also qualifies for businesses who obtained a loan under the Paycheck Protection Program (PPP), including borrowers from the initial round of PPP who originally were ineligible to claim the tax credit.

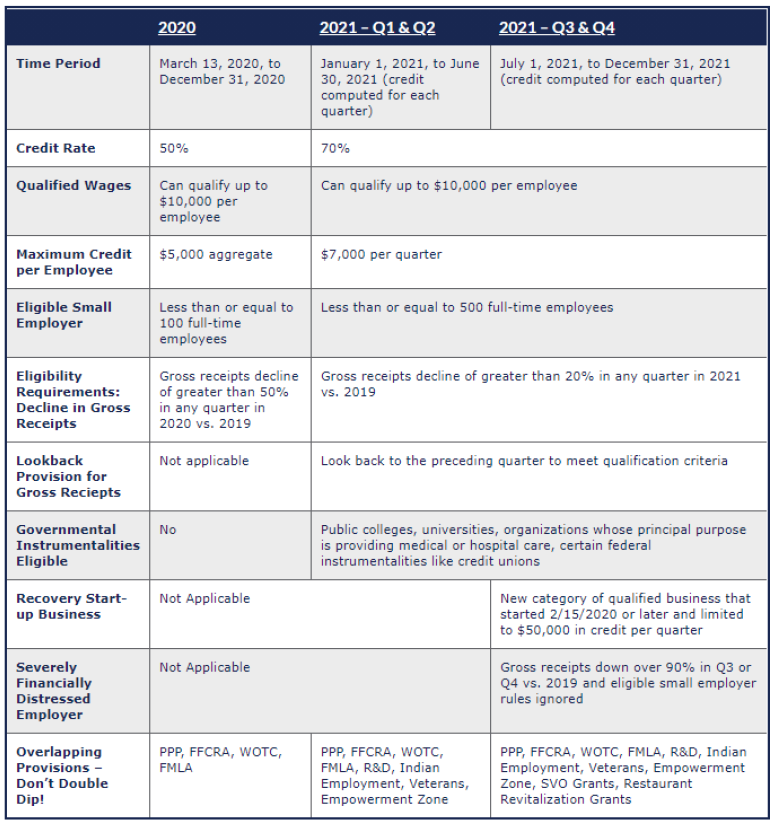

The enhanced ERC follows the more favorable 2021 rules that include:

- Lowering the threshold for meeting the “eligible employer” standard under the gross receipts test (requiring only a 20% decline in gross receipts compared to a 50% decline required for the 2020 ERC)

- Raising the credit rate to 70% (from 50% in 2020)

- Raising the maximum qualified wages to $10,000 per quarter (from $10,000 aggregate for all of 2020)

- Raising the “small employer” limit to 500 full-time employees (compared to 100 full-time employees for the 2020 ERC)—a small employer is allowed to claim all wages paid during the eligibility period; while large employers can only claim the ERC for wages paid to employees not providing services

As a result, the maximum ERC per employee for 2021 is now $28,000, compared to $5,000 for the 2020 version of the ERC.