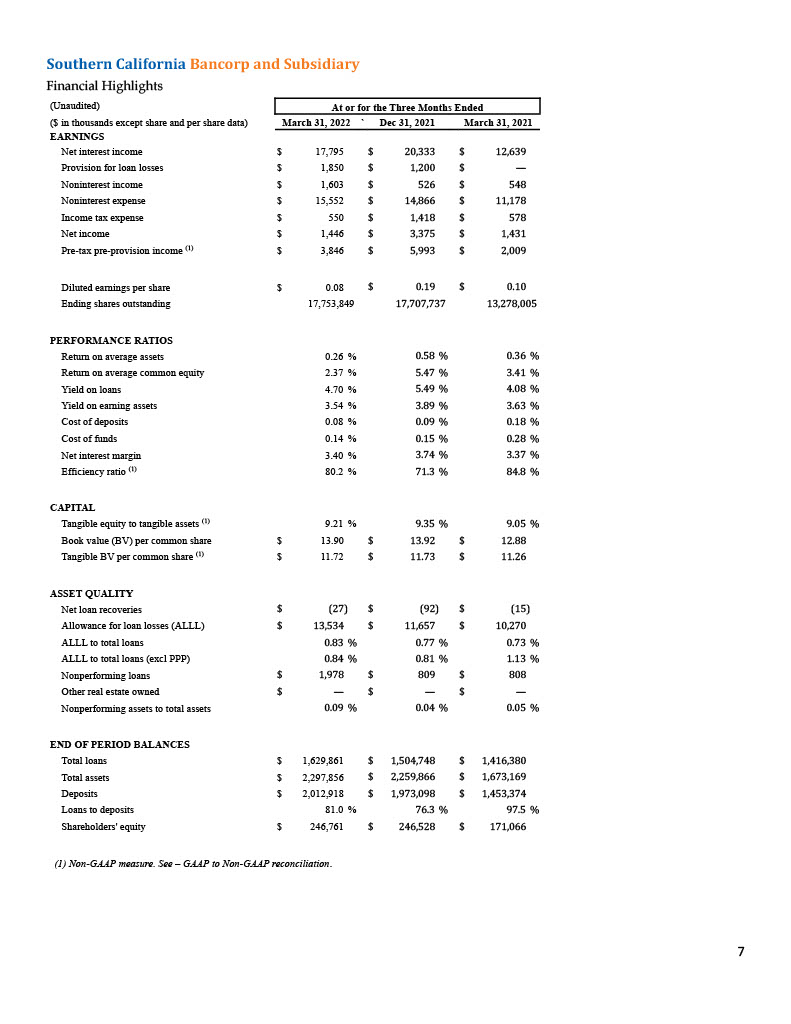

─ First quarter non-PPP organic loan growth of $165.8 million, up 11.5% from prior quarter

San Diego, Calif., April 28, 2022 – Southern California Bancorp (“us,” “we,” “our,” or the “Company”) (OTC Pink: BCAL), the holding company for Bank of Southern California, N.A. (the “Bank”) today reported consolidated financial results for the first quarter of 2022.

The comparability of consolidated financial information for the first quarter of 2022 to the same period of 2021 is affected by the acquisition of Bank of Santa Clarita (“BSCA”) which was completed effective October 1, 2021. Accordingly, BSCA’s operating results are included in the Company’s consolidated financial statements for the periods beginning after October 1, 2021.

First Quarter 2022 Highlights

- Total organic Non-Paycheck Protection Program loans (“non-PPP”) increased to $1.61 billion, up $165.8 million, or 11.5%, from December 31, 2021

- Tangible book value per common share (“TBV”) of $11.72 at March 31, 2022, compared with $11.73 at December 31, 2021

- Total assets of $2.30 billion, up $38.0 million, or 1.7%, from December 31, 2021

- Total deposits of $2.01 billion, up $39.8 million, or 2.0%, from December 31, 2021

- Noninterest-bearing demand deposits were $1.03 billion, representing 51.3% of total deposits, up from 50.0% at December 31, 2021

- Paycheck Protection Program (PPP) loan portfolio balance of $15.1 million, down $43.5 million from December 31, 2021

- Net income of $1.4 million, compared with $3.4 million in the prior quarter

- Non-PPP loan interest income increased $637,000, or 4.0%, over the prior quarter

- Pre-tax, pre-provision income of $3.8 million, compared with $6.0 million in the prior quarter, as PPP income decreased by $3.5 million from the prior quarter

- Provision for loan losses of $1.9 million due to strong loan growth, compared to $1.2 million in the prior quarter

- Net interest margin of 3.40%, compared with 3.74% in the prior quarter; average yield on non-PPP loans of 4.45% compared with 4.58% in the prior quarter

- Cost of deposits was 0.08%, down from 0.09% in the prior quarter

- Nonperforming assets to total assets ratio of 0.09%, compared to 0.04% at December 31, 2021

- Continued status as “well-capitalized,” the highest regulatory capital category

“I am very pleased to report continued strong organic non-PPP loan growth of $166 million in the first quarter of 2022, net of approximately $105 million in payoffs, driven by our strategy of expanding our relationship-based business banking model into Orange, Los Angeles, and Ventura counties, which began just over a year ago and continues to gain traction, as well as continued growth in San Diego County,” said David Rainer, Chairman, CEO and President of Southern California Bancorp and Bank of Southern California, N.A. “Pre-tax, pre-provision income was $3.8 million, compared with $6.0 million in the fourth quarter of 2021, with the decrease due to lower net interest income, as interest and fees on PPP loans declined $3.5 million from the prior quarter and we made a higher provision for loan losses due to strong organic loan growth.

“We have reached an inflection point where income related to PPP loans is ending and is gradually being offset by an increase in interest income generated through continued organic growth in our non-PPP loan portfolio. Interest income from this portfolio increased $637,000, or 4.0% in the first quarter compared with the prior quarter. Our balance sheet remains very asset sensitive and the recent increase in the Federal Funds rate will positively reflect that sensitivity going forward.

“Net income of $1.4 million in the first quarter decreased from $3.4 million in the fourth quarter largely due to the decrease of $3.5 million in PPP-related income, as well as an increase of $650,000 in provision for loan losses resulting from our strong loan growth, coupled with the increase in salary and benefit expenses related to the expansion of the SBA lending division, and the seasonal increase in payroll taxes and benefits expense, as well as onetime costs related to the conversion of our core operating system at both the legacy Bank and our recently acquired Santa Clarita office.

“Deposits grew $39.8 million, or 2% in the first quarter, which was more modest than previous quarters, as we intentionally held off on opening new accounts prior to our core system conversion in early March 2022 to avoid having to repeat the onboarding process for our clients. With our new core system in place at the legacy Bank, deposit account growth has picked up and in late April we successfully converted the core system of our Santa Clarita branch, acquired in the fourth quarter of 2021. We anticipate increased efficiencies from the new core system, especially since all our branches have completed the conversion.

“In addition to deploying our excess liquidity through organic loan originations, as yields increased during the first quarter, we added $83.9 million of securities to our investment portfolio, growing the portfolio by 151% compared to the fourth quarter of 2021. Our tangible book value declined by $0.01 in the first quarter compared with the prior quarter, which included a mark-to-market unrealized loss on our securities portfolio of $2.3 million or $0.13 per share.”

First Quarter Operating Results

Net Income

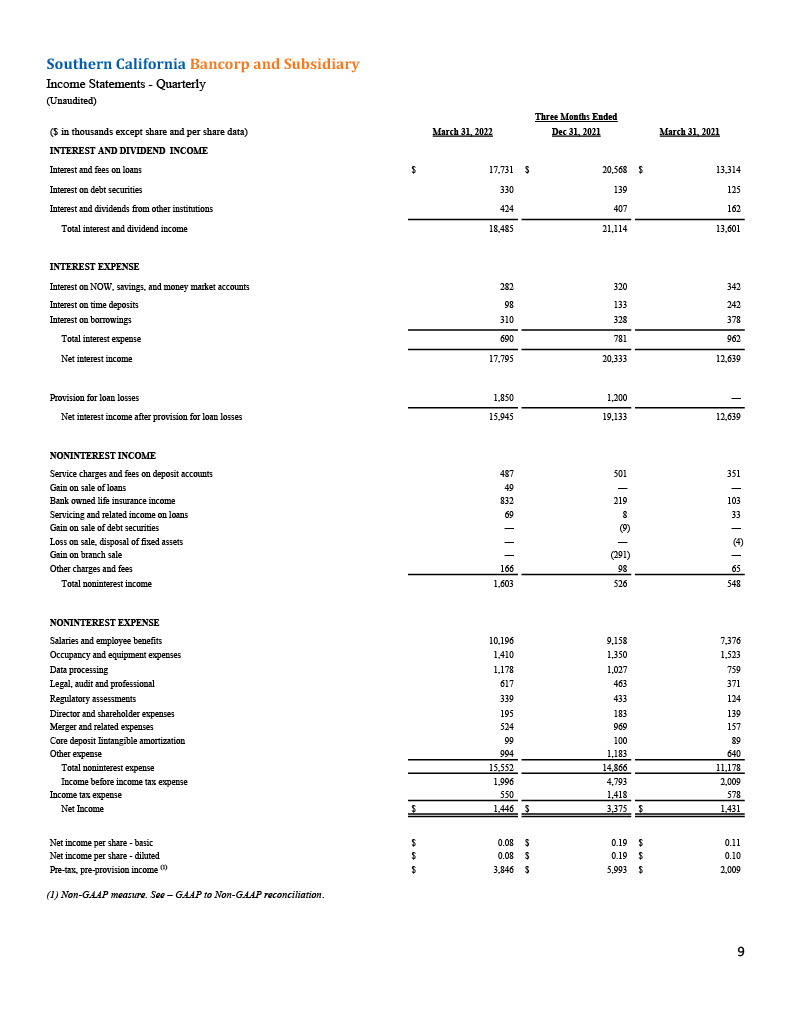

Net income for the first quarter of 2022 was $1.4 million, or $0.08 per diluted share, compared to net income of $3.4 million, or $0.19 per diluted share in the fourth quarter of 2021. Pre-tax, pre-provision income for the first quarter of 2022 was $3.8 million, compared to pre-tax, pre-provision income of $6.0 million in the prior quarter. The decrease in net income in the first quarter of 2022 compared with the fourth quarter of 2021 was primarily due to a $2.5 million decrease in net interest income, a $650,000 increase in provision for loan losses, and a $686,000 increase in noninterest expense, partially offset by an $1.1 million increase in noninterest income and a $868,000 decrease in income tax expense.

Net income for the first quarter of 2022 was $1.4 million, or $0.08 per diluted share, compared to net income of $1.4 million or $0.10 per diluted share in the first quarter of 2021. Pre-tax, pre-provision income for the first quarter of 2022 was $3.8 million, an increase of $1.8 million, or 91.4% compared to pre-tax, pre-provision income of $2.0 million for the first quarter of 2021. The increase in net income in the first quarter of 2022 compared with the year-ago quarter was primarily due to a $5.2 million increase in net interest income, and a $1.1 million increase in noninterest income, partially offset by an increase in noninterest expense of $4.4 million and a provision for loan losses of $1.9 million; in the year-ago quarter, the Company recorded no provision for loan losses.

Net Interest Income and Net Interest Margin

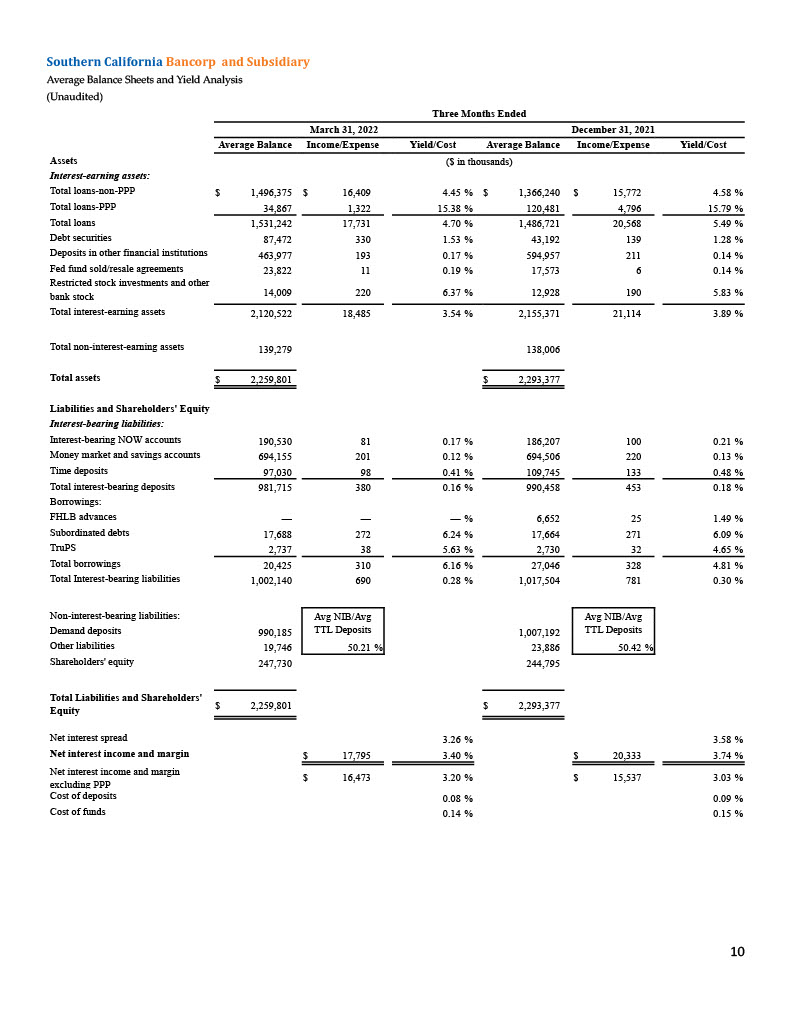

Net interest income for the first quarter of 2022 was $17.8 million, compared with $20.3 million in the prior quarter. While first quarter non-PPP loan interest income increased by $637,000, or 4%, and interest expense decreased by $91,000, a decrease in income from PPP loans of $3.5 million resulted in a $2.5 million decrease in net interest income.

Net interest margin for the first quarter of 2022 was 3.40%, compared with 3.74% in the prior quarter. The decrease was primarily related to lower PPP fee and interest income in the first quarter of 2022. The yield on average loans in the first quarter of 2022 was 4.70%, a decrease of 79 basis points from 5.49% in the prior quarter. The decrease was primarily the result of a decrease in the PPP interest income due to lower accelerated deferred loan fees resulting from SBA PPP loan forgiveness during the first quarter of 2022, coupled with lower accelerated discount accretion from acquired and purchased loans. The yield on average loans in the first quarter of 2022, excluding PPP loans, was 4.45%, a decrease of 13 basis points from 4.58% in the prior quarter. Average PPP loan yields in the first quarter of 2022 decreased to 15.38%, compared to 15.79% in the prior quarter. The yield on total earning assets in the first quarter of 2022 was 3.54%, compared with 3.89% in the prior quarter.

Cost of funds for the first quarter of 2022 was 0.14%, down from 0.15% in the prior quarter, as the Company continues to align funding costs of the legacy Bank of Santa Clarita with those of the Bank of Southern California. Average noninterest-bearing demand deposits decreased $17.0 million to $990.2 million and represented 50.2% of total average deposits for the first quarter of 2022, compared with $1.01 billion and 50.4%, respectively, for the prior quarter. The total cost of deposits in the first quarter of 2022 was 0.08%, down from 0.09% in the prior quarter.

Average total borrowings decreased $6.6 million to $20.4 million for the first quarter of 2022. The average cost of borrowings was 6.16%, up from 4.81% in the prior quarter.

Provision for Loan Losses

The Company recorded a loan loss provision of $1.9 million in the first quarter of 2022, primarily related to strong organic loan growth. In the fourth quarter of 2021, the Company recorded a loan loss provision of $1.2 million. The Company’s management continues to monitor macroeconomic variables related to COVID-19 and reasonably believes it is appropriately provisioned for the current environment.

Noninterest Income

Total noninterest income in the first quarter of 2022 was $1.6 million, an increase of $1.1 million compared with noninterest income of $526,000 in the fourth quarter of 2021. The increase was due primarily to a $613,000 increase in bank owned life insurance income. In the first quarter of 2022, income from servicing and related income on loans increased by $61,000 and other charges and fees increased by $68,000, compared with the prior quarter. Additionally, in the fourth quarter of 2021 the Company recorded an adjustment of $291,000 from the gain on branch sale that took place in the third quarter of 2021, for which there was no corresponding transaction in the first quarter of 2022.

Noninterest Expense

Noninterest expense for the first quarter of 2022 increased $686,000 to $15.6 million, compared with $14.9 million in the prior quarter. The increase was primarily due to an increase of $1.0 million in salaries and benefits related to the increase in new hires, including the expansion of the SBA lending division, and seasonal increases in payroll taxes and benefits expense, partially offset by a decrease of $445,000 in merger and related expenses.

Income Tax

In the first quarter of 2022, the Company’s income tax expense was $550,000, compared with $1.4 million in the fourth quarter of 2021. The effective rate was 27.6% for the first quarter of 2022 and 29.6% for the fourth quarter of 2021. The effective tax rate for 2022 is expected to be 27.6%.

Balance Sheet

Assets

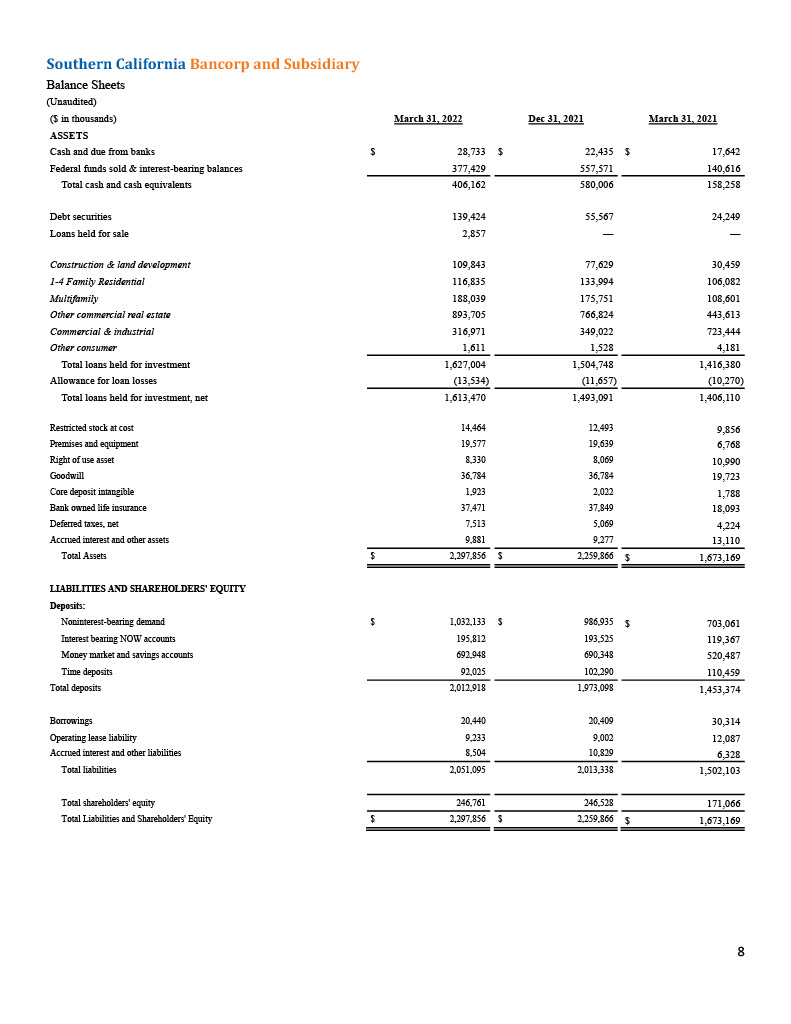

Total assets at March 31, 2022, were $2.30 billion, an increase of $38.0 million or 1.7% from December 31, 2021. The increase in total assets from the prior quarter was primarily related to a $125.1 million increase in total loans and an $83.9 million increase in debt securities, of which $44.9 million were classified as held-to-maturity securities, partially offset by a $173.8 million decrease in cash.

Loans

Total loans held for investment were $1.63 billion at March 31, 2022, compared to $1.50 billion at December 31, 2021. In the first quarter of 2022, the Company’s loans held for investment, excluding PPP loans, had net organic growth of $165.8 million, or 11.5%, after total loan principal payoffs of approximately $105 million, and an outstanding organic non-PPP loan balance of $1.61 billion at March 31, 2022. There were $2.9 million in loans held for sale on the Company’s balance sheet at March 31, 2022, related to the expansion of the SBA lending department, which are expected to be sold in the secondary market in the second quarter of 2022.

During the first quarter of 2022, total commercial and industrial loans decreased by $32.1 million, as $43.5 million in PPP loans received forgiveness or pay downs, leaving an outstanding balance of $15.1 million in PPP loans at March 31, 2022. Total loans secured by real estate increased by $122.0 million, and construction and land development loans increased by $32.2 million.

Deposits

Total deposits at March 31, 2022, were $2.01 billion, an increase of $39.8 million from December 31, 2021. Noninterest-bearing demand deposits at March 31, 2022 were $1.03 billion, or 51.3% of total deposits, compared to $986.9 million, or 50.0% of total deposits at December 31, 2021.

Asset Quality

Total non-performing assets totaled $2.0 million or 0.09% of total assets at March 31, 2022, compared with $809,000 or 0.04% at December 31, 2021. The increase in nonperforming loans in the first quarter of 2022 was primarily due to three loans that were downgraded to nonaccrual, partially offset by the payoff of one nonaccrual loan. The Company had one loan with a carrying value of $208,000 over 90 days past due that was still accruing interest at March 31, 2022. During the first quarter of 2022, the Company recorded net recoveries of $27,000, compared to net recoveries of $92,000 in the fourth quarter of 2021.

Loan delinquencies (30-89 days past due) totaled $491,000 at March 31, 2022, compared to $1.0 million at December 31, 2021.

The allowance for loan losses (“ALLL”) was $13.5 million at March 31, 2022, compared to $11.7 million at December 31, 2021. The ALLL to total loans was 0.83% and 0.77% at March 31, 2022, and December 31, 2021. The ALLL to total loans, excluding PPP loans was 0.84% and 0.81% at March 31, 2022, and December 31, 2021. The net carrying value of acquired loans totaled $345.5 million and included a remaining net discount of $2.6 million at March 31, 2022. This discount is available to absorb losses on the acquired loans and represented 0.74% of the net carrying value of acquired loans and 0.16% of total gross loans held for investment.

Liquidity and Capital

At March 31, 2022, total deposits had increased 38.5% over the same period of 2021. As a result of this significant growth in deposits and a strong cash balance due to the quick pace of PPP loan forgiveness, we believe that we currently have sufficient liquidity resources to meet the needs of Bank customers.

Tangible book value per common share at March 31, 2022, was $11.72, compared with $11.73 at December 31, 2021. The $0.01 decrease from December 31, 2021, was primarily related to the $2.3 million increase in the accumulated other comprehensive loss related to the fair value of debt securities available for sale, compared to $38,000 at December 31, 2021.

The Bank’s leverage capital ratio and total risk-based capital ratio were 10.08% and 13.70%, respectively, at March 31, 2021.

ABOUT BANK OF SOUTHERN CALIFORNIA AND SOUTHERN CALIFORNIA BANCORP

Southern California Bancorp (OTC Pink: BCAL) is a registered bank holding company headquartered in San Diego, California. Bank of Southern California, N.A., a national banking association chartered under the laws of the United States and regulated by the Office of Comptroller of the Currency, is a wholly owned subsidiary of Southern California Bancorp. Established in 2001 and headquartered in San Diego, California, Bank of Southern California, N.A. offers a range of financial products and services to individuals, professionals, and small- to medium-sized businesses through its 13 branch offices serving San Diego, Orange, Los Angeles, and Ventura counties, as well as the Inland Empire. The Bank’s solutions-driven, relationship-based approach to banking provides accessibility to decision makers and enhances value through strong partnerships with its clients. Additional information is available at www.banksocal.com. Southern California Bancorp’s common stock is traded on the OTC Markets Group Inc. Pink Open Market under the symbol “BCAL.” For more information, please visit banksocal.com or call (844) BNK-SOCAL.

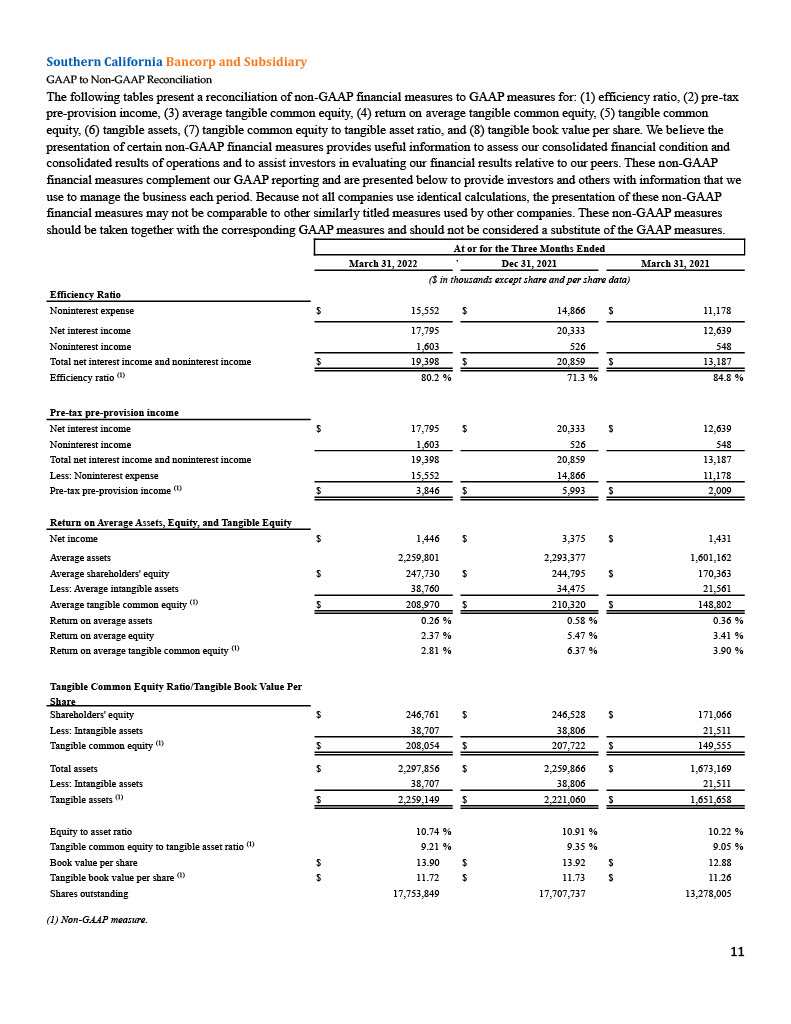

NON-GAAP FINANCIAL MEASURES

This press release contains certain non-GAAP financial measures in addition to results presented in accordance with GAAP. The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s results of operations and financial condition and to enhance investors’ overall understanding of such results of operations and financial condition, permit investors to effectively analyze financial trends of our business activities, and enhance comparability with peers across the financial services sector. These non-GAAP financial measures are not a substitute for GAAP measures and should be read in conjunction with the Company’s GAAP financial information. A reconciliation of GAAP financial measures to non-GAAP financial measures is included in the accompanying financial tables.

FORWARD-LOOKING STATEMENTS

In addition to historical information, certain matters set forth herein constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including forward-looking statements relating to management’s beliefs, projections and assumptions concerning future results and events. Forward-looking statements include descriptions of management’s plans or objectives for future operations, products or services, and forecasts of Southern California Bancorp’s revenues, earnings, or other measures of economic performance. As well, forward-looking statements may relate to future outlook and anticipated events. These forward-looking statements involve risks and uncertainties, based on the beliefs and assumptions

of management and on the information available to management at the time that such forward-looking statements were made and can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words or phrases such as “aim,” “can,” “may,” “could,” “predict,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “hope,” “intend,” “plan,” “potential,” “project,” “will likely result,” “continue,” “seek,” “shall,” “possible,” “projection,” “optimistic,” and “outlook,” and variations of these words and similar expressions or the negative version of those words or phrases. Forward-looking statements involve substantial risks and uncertainties, many of which are difficult to predict and are generally beyond our control. Many factors could cause actual results to differ materially from those contemplated by these forward-looking statements. Except to the extent required by applicable law or regulation, Southern California Bancorp does not undertake, and specifically disclaims any obligation, to update any forward-looking statements to reflect occurrences or unanticipated events or circumstances after the date of such statements except as required by law.