SOUTHERN CALIFORNIA BANCORP ANNOUNCES RESULTS FOR THE THIRD QUARTER 2020

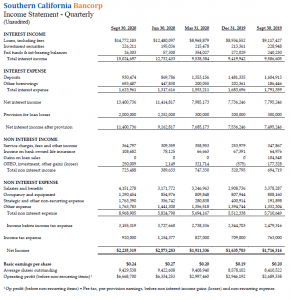

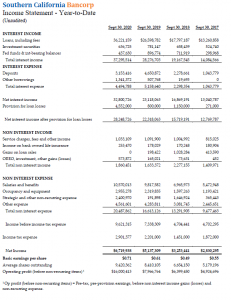

San Diego Calif., October 27, 2020 – Southern California Bancorp (the “Company”) (OTC Pink: BCAL), the holding company for Bank of Southern California, N.A. (the “Bank”) today reported net income of $2.24 million for Q3 2020, or $0.24 per diluted share, compared to net income of $2.57 million or $0.27 per diluted share, for Q2 2020. After considering non-recurring strategic expenses, pre-tax pre-provision, operating profit increased to $6.67 million in Q3 vs. $6.33 million in Q2 and for the nine months ended September 30, 2020 increased to $16 million vs. $8 million for the nine months of 2019.

THIRD QUARTER 2020 HIGHLIGHTS

As previously announced, the Company acquired CalWest Bancorp (“CalWest”) at the end of May, and in mid-August, successfully completed the conversion of CalWest into the Bank, adding $221 million in loans, $241 million in deposits, and $312 million in assets at the time of acquisition. In reference to this achievement, Nathan Rogge, President and CEO of Bank of Southern California stated, “We are pleased to report that we have retained 97% of CalWest customers. We look forward to further building upon our relationships with our newest clients and supporting them with the enhanced products and services, increased footprint, and superior service that customers have come to expect from Bank of Southern California.”

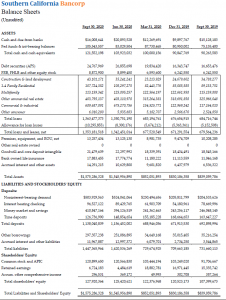

During Q3, organic loan and deposit growth coupled with the extension of PPP were offset by both continued challenges related to the ongoing COVID-19 pandemic and anticipated non-recurring expenses associated with data conversion of CalWest customers to the Bank’s core platform. At quarter-end, total assets increased from $1.55 billion in Q2 2020 to $1.58 billion in Q3 2020. The following details summarize Q3 results:

- Total loan portfolio increased $13 million to $1.36 billion; total loan production over the quarter was $80 million including $15 million in new PPP Loans

- The Bank continued its leadership role within the communities it serves by actively participating in the extended Paycheck Protection Program (PPP), funding over 730 new PPP Loans in Q3, in addition to more than 2,300 PPP Loans funded in Q2.

- The Bank received over $35 million in loan payoffs over the quarter due to the competitive rate environment following the Federal Reserve’s 150 bps reduction at the end of the first quarter

- Total deposits Q/Q decreased $18 million to $1.14 billion primarily related to a planned $22 million reduction in non-core time deposits. Other non-maturity deposits increased $4 million – supported by the conversion of over 650 PPP Loan customers to deposit banking relationships

- Quarterly operating results were significantly impacted by strategic non-recurring events, including:

- CalWest system conversion and branch repositioning expenses of $1.76 million

- An additional $2.0 million loan loss provision driven by economic uncertainties from COVID-19.

NET INTEREST INCOME AND RATIO OVERVIEW

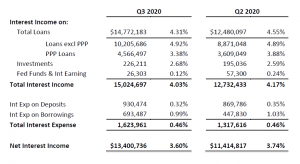

Net interest income increased $1.99 million, or 17%, Q/Q primarily associated with the 21% increase in average earning assets from Q2 to Q3 associated with closing the CalWest merger in Q2 and the growth associated with PPP in Q2.

Average loan yields, excluding PPP Loans, increased slightly by 3 bps Q/Q from 4.89% to 4.92%. PPP Loan yields fell 50 bps Q/Q due to the slow rollout of SBA forgiveness and subsequent adjustments to the Bank’s PPP Loan fee accretion. Cost of funding remained flat Q/Q as other deposits replaced non-core maturing time certificates. A detailed comparison of Q/Q interest income, yields, costs, and net interest income is included below:

LIQUIDITY AND CAPITAL

The Bank has ample liquidity resources to meet its customer’s needs through both the Federal Home Loan Bank (FHLB) and Federal Reserve Bank’s PPP Liquidity Facility (PPP LF). At September 30, 2020, combined borrowing capacity available at both the FHLB and through PPP LF was over $400 million.

The significant growth in PPP Loans in Q2 and Q3 has been funded through a combination of increased DDA accounts, generally associated directly with the PPP Loans, borrowings under PPP LF, and other sources. On average during Q3, the total PPP Loan portfolio was funded through 50% DDA growth, 45% from borrowings, and 5% from other balance sheet liquidity.

PPP Loans are considered zero risk-weighted assets and PPP LF advances are not counted in the leverage ratio. As such, preferential capital treatment of PPP LF advances has helped maintain the Bank’s leverage capital ratio for Q3 at 9.2% and total risk-based capital ratio for Q3 at 15.9%.

CREDIT QUALITY AND ALLOWANCE FOR LOAN LOSSES

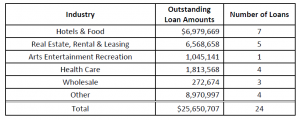

The allowance for loan losses (ALLL) increased from $8.30 million in Q2 to $10.30 million in Q3, primarily from $2.00 million in provisions for loan losses due to the continued unpredictability related to macroeconomic variables caused by COVID-19. As the initial onset of economic uncertainty became clearer, many customers who elected a payment deferral have been returned to paying status; a total of $151 million in loans have reinstated their normal loan payments. Of the remaining 24 loans currently on deferral, the following table details the exposure by industry:

Loans classified as nonperforming and loan charge-offs continue to be at very low levels. However, management believes the addition of $2.0 million as provision for loan losses during Q3, successive to the $2.25 million added in Q2, prudent and conservative considering the continued uncertainties related to COVID-19. Management will continue to monitor and manage the loan portfolio to minimize potential future losses.

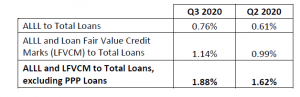

Relevant reserve ratios compared to the prior quarter are as follows:

BRANCH PLANS AND FUTURE GROWTH

The Bank’s overarching goal is to continuously develop as a first-class provider of banking needs for small and mid-sized businesses within Southern California. To achieve this goal, the Bank has outlined a three-pronged approach; expanding within its current market through new branch development, deepening its existing market presence by consistently providing exceptional customer service with incredible banking solutions, and streamlining banking operations by consolidating branch banking functions.

Growth within existing markets is being realized with the addition of a new branch in the San Diego market, located in downtown La Jolla village. This branch will offer additional banking access for existing customers as well as the opportunity to engage new potential clients within La Jolla. The branch is currently under development with an expected opening in the first quarter of 2021.

The Bank is deepening its presence in existing locations by providing enhanced training and service capabilities at our branches. Over time, the Bank is aiming for even deeper customer relationships within the markets it serves, which Mr. Rogge elaborated on by saying, “We are excited about the growth we are experiencing across our newest markets, specifically in Los Angeles County and Orange County. As we look ahead to 2021, we will be working towards expanding our business banking teams to better serve Southern California’s business community.”

This focus on first-class customer service as a tool to expand an existing market footprint has come to fruition at the Glendale branch. Due to exceptional growth, this branch outgrew its original location, and is moving to a larger branch location in the fourth quarter.

The Bank continuously evaluates opportunities for greater operational efficiency and, as a result, recently consolidated two branches in Los Angeles County and one branch in Orange County into existing locations. In reference to the branch consolidations, Mr. Rogge stated, “Last quarter, we successfully consolidated a few of our branch locations that served overlapping regions, while providing the bank with the opportunity to realize efficiencies.”

FORWARD-LOOKING STATEMENTS

This press release may contain comments or information that constitute forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) and Southern California Bancorp and its subsidiary, Bank of Southern California, N.A., intends for such forward-looking statements to be covered by the safe harbor provisions of that Act. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” Forward-looking statements are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties and actual results may differ materially from those presented, in this news release. Factors that might cause such differences include, but are not limited to: the impact of the COVID-19 on the economy and the Company; the ability of the Company to successfully execute its business plan; changes in interest rates and interest rate relationships; changes in demand for products and services; changes in banking legislation or regulation; trends in customer behavior as well as their ability to repay loans; and changes in the global, national, and local economies.

Southern California Bancorp undertakes no obligation to update or clarify forward-looking statements, whether as a result of new information, future events or otherwise.