San Diego, Calif., July 28, 2021 – Southern California Bancorp (the “Company”) (OTC Pink: BCAL), the holding company for Bank of Southern California, N.A. (the “Bank”) today reported financial results for the second quarter of 2021.

SECOND QUARTER 2021 HIGHLIGHTS

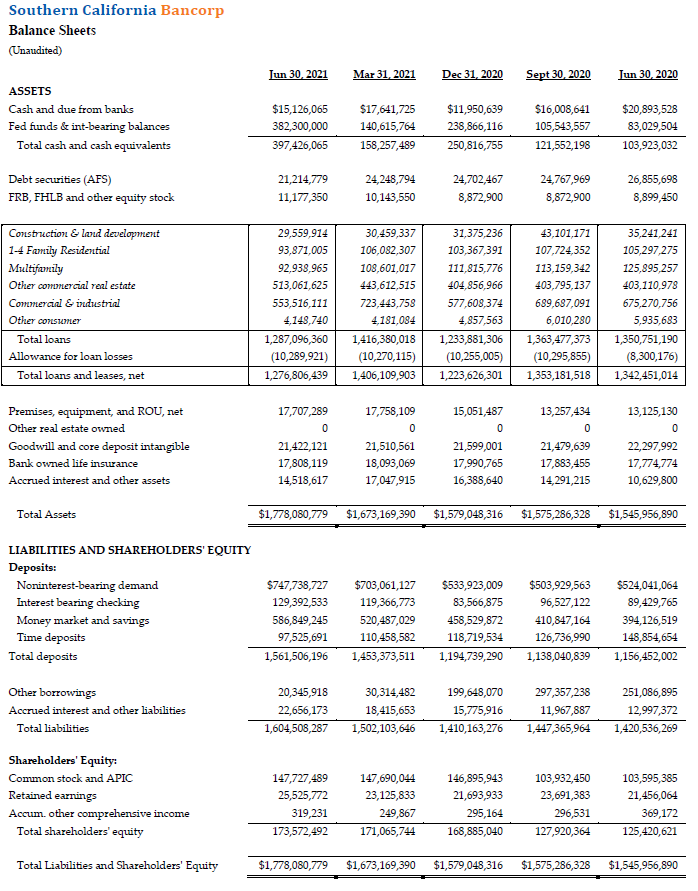

- Total assets increased to $1.8 billion, up $104.9 million or 6.3% from March 31, 2021, and $199 million or 12.6% from December 31, 2020

- Total deposits increased to $1.6 billion, up $108.1 million or 7.4% from March 31, 2021, and $366.8 million or 30.7% from December 31, 2020

- Noninterest bearing demand deposits were 47.9% of total deposits at June 30, 2021

- Total Non-paycheck protection program (PPP) loans increased to $940.1 million, up $36.9 million, or 4.1% from March 31, 2021, and $113.0 million or 13.7% from December 31, 2020

- Forgiveness submitted and payoffs received for 61% and 57%, respectively, of the entire $799.1 million PPP portfolio, with a $346.6 million balance remaining at June 30, 2021

- Net interest margin of 3.72% in the second quarter; excluding PPP loans, the net interest margin was 3.73%

- Nonperforming assets to total assets of 0.04% at June 30, 2021

- Announced acquisition of Bank of Santa Clarita, which will expand footprint into northern Los Angeles County and create commercial bank with approximately $2.2 billion in pro forma assets

- Announced sale of three branches to align footprint to support a commercial banking strategy

- Continued status as well-capitalized, the highest regulatory capital category

On June 29, 2021, following the departure of Nathan Rogge, the Southern California Bancorp and Bank of Southern California Boards of Directors appointed David Rainer President and Chief Executive Officer of Southern California Bancorp and Bank of Southern California.

“I’m honored to have our Board’s confidence and excited to be leading the Company as we continue to execute on the strategic growth plan presented to investors during last year’s capital raise,” said David Rainer, Chairman, President and Chief Executive Officer of Southern California Bancorp and Bank of Southern California. “We have made significant progress on that plan, including the opening of three banking offices in West Los Angeles, Encino and Westlake Village, all of which are key locations for commercial banking. In the second quarter we also announced the acquisition of Bank of Santa Clarita, which has a commercial banking business model very complementary to ours and is in the attractive banking community of northern Los Angeles County; we have received regulatory approval and expect that transaction to close in the fourth quarter, pending shareholder approval. Additionally, we have arranged for the sale of three branches that are not in alignment with our commercial business banking focus and that transaction is expected to close in the third quarter. Our execution on all these initiatives places us in an excellent position for continued growth, especially given the recovering economy.

“I’m pleased to report the Bank achieved net organic non-PPP loan growth of $37 million in the second quarter, despite the headwinds of payoffs and paydowns of $70 million, and that loan credit quality remains pristine, with the ratio of nonperforming assets to total assets ending the quarter at 0.04%.

“Second quarter net income of $2.4 million was impacted by nonrecurring compensation expenses but was significantly improved from $1.4 million in the first quarter. Quarterly net interest income of $15.4 million, which benefitted from $3.2 million in fee income related to the accelerated forgiveness on PPP loans, was a major driver of the increase. Net income also benefitted from the $920,000 gain on sale of a nonaccrual loan.

“Our employees worked diligently through two rounds of PPP loan originations totaling nearly $800 million to provide timely economic relief to businesses in our local community during the pandemic. These loans were made to both current and new customers, and we have been focused, with much success, on converting those new customers to ongoing banking relationships. Of the total PPP loans originated, at the end of the second quarter we had submitted 61% for forgiveness and received payoffs for 57%, reducing the Bank’s PPP outstanding loan balance to $347 million at June 30, 2021. The acceleration of PPP loan forgiveness has increased cash on our balance sheet, which will be deployed to fund new loans, and over time make additions to our investment portfolio, with some cash reduction related to the planned sale of three Bank branches later this year.”

SECOND QUARTER OPERATING RESULTS

Net Income

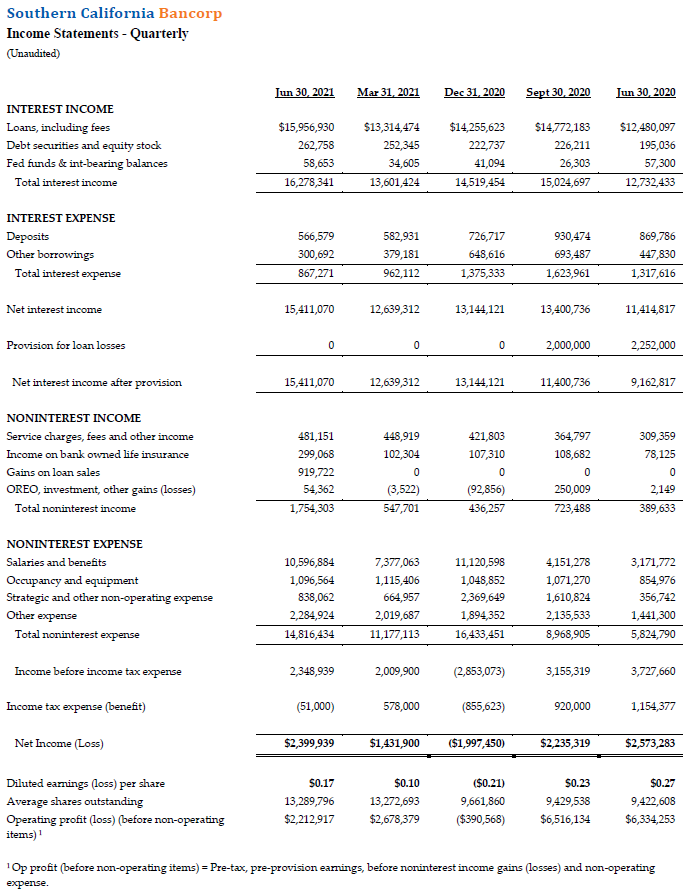

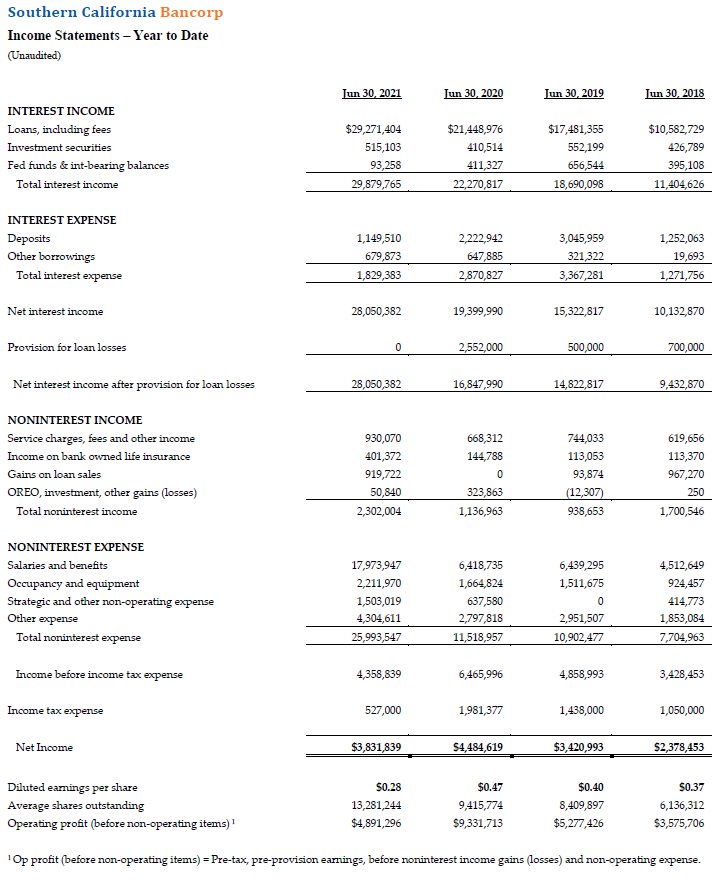

Net income for the second quarter of 2021 was $2.4 million or $0.17 per fully diluted share, compared with net income of $2.6 million or $0.27 per fully diluted share for the second quarter of 2020. The decrease in net income from the prior year was largely due to a $9.0 million increase in total noninterest expenses, primarily related to the acquisition of CalWest and the Company’s recent strategic expansion into Los Angeles County, as well as $3.1 million in nonrecurring compensation expenses related to a preexisting employment contract. This increase in noninterest expenses was partially offset by a $4.0 million increase in net interest income, a reduction of $2.2 million in the provision for loan losses and an increase of $1.4 million in noninterest income.

Net income for the second quarter of 2021 was $2.4 million or $0.17 per fully diluted share, compared with net income of $1.4 million or $0.10 per fully diluted share in the first quarter of 2021. The increase in net income in the second quarter of 2021 was largely due to a $2.8 million increase in net interest income compared with the first quarter of 2021, and nonrecurring gains of $974,000, partially offset by increased noninterest expenses of $3.6 million.

The Company’s financial results for the second quarter of 2021 benefitted from the recording of tax benefits associated with the acceleration and vesting of certain restricted share awards and the exercise of certain stock options. The Company’s income tax would have been approximately $740,000 higher in the second quarter without those benefits.

Net Interest Income and Net Interest Margin

Net interest income for the second quarter of 2021 was $15.4 million, an increase of $4.0 million or 35% from the second quarter of 2020. The increase was primarily due to an increase in average earning assets from the acquisition of CalWest, the Company’s expansion into Los Angeles County and increased PPP fee income due to the accelerated pace of PPP loan forgiveness. Comparisons to the prior year also benefit from a reduction in interest expense of $450,000 resulting in cost of funding decreasing to 0.22% from 0.46% in the prior year.

Net interest margin for the second quarter of 2021 was 3.72%, compared with 3.74% in the same quarter of the prior year. Second quarter loan yields and yield on average earning assets were 4.61% and 3.92%, respectively, compared with 4.55% and 4.17%, respectively, in the prior year. Excluding PPP loans, the net interest margin would have been 3.73% in the second quarter of 2021.

Net interest income for the second quarter of 2021 was $15.4 million, an increase of $2.8 million from first quarter of 2021. The increase was primarily due to organic loan growth; increased PPP net fee income of $3.2 million in the second quarter compared with $2.2 million in the previous quarter, related to the accelerated pace of PPP loan forgiveness; the accretion of fair value discount from a prior acquisition; and, an additional day of interest income in the second quarter.

Interest expense in the second quarter of 2021 was $867,000 a decrease of $95,000 or 9.9% from interest expense of $962,000 in the first quarter of 2021. The decrease was primarily related to a reduction in average borrowings associated with the paying-off of borrowings from the Federal Reserve Bank under the Paycheck Protection Program Liquidity Funding (PPPLF).

Net interest margin for the second quarter of 2021 was 3.72%, compared to 3.38% in the first quarter of 2021. The increase in net interest margin in the second quarter of 2021 was largely due to an increase in the yield on average earning assets to 3.92%, from 3.63% in the prior quarter.

The yield on average loans in the second quarter of 2021, excluding PPP loans, was 5.00%, an increase of 26 basis points from 4.74% in the prior quarter. Average PPP loan yields increased to 3.83% in the second quarter, compared to 2.90% in the prior quarter. The increase in PPP loan yields was primarily due to the increase in fee income due to the accelerated pace of loan forgiveness. The increase in non-PPP loan yields was primarily due to nonrecurring income of $437,000 related to elevated prepayment penalties and the fair value accretion of an acquired loan.

Cost of funding for the second quarter of 2021 was 0.22%, down from 0.28% in the previous quarter. A detailed comparison of interest income, yields, costs, and net interest income is included in the table below:

| Q2 2021 | Q1 2021 | |||||

| Interest Income on: | ||||||

| Total Loans | $15,956,930 | 4.61% | $13,314,474 | 4.08% | ||

| Loans excl PPP | 11,586,549 | 5.00% | 9,954,156 | 4.74% | ||

| PPP Loans | 4,370,381 | 3.83% | 3,360,318 | 2.90% | ||

| Investments | 262,758 | 3.05% | 252,345 | 3.02% | ||

| Fed Funds & Int Earning | 58,653 | 0.10% | 34,605 | 0.09% | ||

| Total Interest Income | 16,278,341 | 3.92% | 13,601,424 | 3.63% | ||

| Int Exp on Deposits | 566,579 | 0.15% | 582,931 | 0.18% | ||

| Int Exp on Borrowings | 300,692 | 4.93% | 379,181 | 1.54% | ||

| Total Interest Expense | 867,271 | 0.22% | 962,112 | 0.28% | ||

| Net Interest Income | $15,411,070 | 3.72% | $12,639,312 | 3.38% | ||

Noninterest Income

Total noninterest income for the second quarter of 2021 was $1.8 million, an increase of $1.4 million compared with $390,000 in the second quarter of the prior year. The increase in the second quarter of 2021 included a gain on sale of $920,000 for an acquired loan that had been on nonaccrual, for which there was no corresponding transaction in the second quarter of 2020, as well as a $221,000 increase in income on bank owned life insurance and a $172,000 increase in service charges, fees and other income.

Total noninterest income in the second quarter of 2021 increased by $1.2 million compared with the first quarter of 2021, primarily due to the gain on sale of an acquired loan noted above, and a $197,000 increase in income on bank owned life insurance.

Balance Sheet

Assets

Total assets at June 30, 2021, were $1.8 billion, an increase of $199 million or 12.6% from December 31, 2020. The increase in total assets was primarily related to a $366.8 million increase in deposits, offset by a $179.3 million decrease in other borrowings, primarily PPPLF.

Loans

Total loans were $1.3 billion at June 30, 2021, compared with $1.4 billion at March 31, 2021, and June 30, 2020. The Company’s non-PPP loan portfolio had net organic growth of $36.9 million or 4.1% in the second quarter of 2021, after payoffs and paydowns of $70 million, and ended the quarter at $940.1 million.

Total commercial and industrial loans decreased by $169.9 million during the second quarter of 2021, of which $166.2 million was a reduction in total PPP loans. Loans secured by real estate grew by $40.7 million in the second quarter of 2021 compared with the prior quarter.

From April 2020 to May 2021 the Company originated 5,084 PPP loans for a total of $799.1 million. At June 30, 2021, the Company had submitted 2,650 PPP loans totaling $488.3 million for forgiveness, of which 2,544 PPP loans totaling $452.1 million were paid off. Total remaining PPP loans outstanding at June 30, 2021, was $347.0 million.

Deposits

Total deposits at June 30, 2021, were $1.6 billion, an increase of $108.1 million from the end of the prior quarter and an increase of $405.1 million from the year-ago period. Noninterest-bearing deposits at June 30, 2021, were $747.7 million or 47.9% of total deposits, compared to $703.1 million or 48.4% of total deposits at March 31, 2021, and $524.0 million or 45.3% of total deposits at June 30, 2020.

Asset Quality

Total non-performing assets were $0.7 million or 0.04% of total assets at June 30, 2021, compared with $0.8 million or 0.05% of total assets at March 31, 2021.

During the second quarter of 2021 the Company recorded net recoveries of $20,000, compared with $374,000 in net recoveries in the second quarter of 2020 and $15,000 in net recoveries in the first quarter of 2021.

The Company recorded no loan loss provision in the first and second quarters of 2021, after recording $4.6 million in provisions for the full year of 2020, and the allowance for loan and lease losses (ALLL) remained at $10.3 million at the end of the second quarter of 2021. The Company continues to monitor macroeconomic variables related to COVID-19 and believes it is adequately provisioned for the current environment. Management will continue to monitor and manage the loan portfolio to minimize potential future losses.

As the initial onset of economic uncertainty became clearer, many customers who elected a payment deferral have been returned to paying status; a total of $183 million in loans have reinstated their normal loan payments. The remaining three loans currently on deferral total $2.9 million and include two health care loans and one real estate loan.

Relevant reserve ratios compared to the prior and year-ago quarter are as follows:

| Q2 2021 | Q1 2021 | Q2 2020 | |

| ALLL to Total Loans | 0.80% | 0.73% | 0.61% |

| ALLL and Loan Fair Value Credit Marks (LFVCM) to Total Loans | 0.99% | 1.00% | 0.99% |

| ALLL and LFVCM to Total Loans, excluding PPP Loans | 1.36% | 1.57% | 1.62% |

Liquidity and Capital

With 7.4% growth in total deposits in the second quarter, and a strong cash balance from the quick pace of forgiveness of PPP loans, the Bank has ample liquidity resources to meet its customers’ needs. Additionally, the Bank has borrowing capacity of $187 million from the FHLB, with no outstanding borrowings at June 30, 2021.

The significant growth in PPP loans over the past 18 months has been funded through a combination of increased DDA accounts, generally associated directly with the PPP Loans, borrowings under PPPLF, and other sources. At June 30, 2021, the Bank’s PPP loan portfolio was entirely funded by Bank deposits.

PPP loans are considered zero risk-weighted assets, and as such have helped maintain the Bank’s leverage capital ratio and total risk-based capital ratio at 9.74% and 17.45%, respectively, for the quarter ended June 30, 2021.

FORWARD-LOOKING STATEMENTS

This news release may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended, and Southern California Bancorp (the “Company”) intends for such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Future events are difficult to predict, and the expectations described above are necessarily subject to risk and uncertainty that may cause actual results to differ materially and adversely. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” These forward-looking statements are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties and actual results may differ materially from those presented, either expressed or implied, in this news release. Factors that might cause such differences include, but are not limited to: the effects of the COVID-19 pandemic, or other similar outbreaks, including the effects of the steps being taken to address the pandemic and their impact on the Company’s markets, customers and employees; the ability of the Company to successfully execute its business plans and achieve its objectives, including consummating the sale of three branches and consummating the merger with Bank of Santa Clarita, and including achieving the expected revenue synergies and cost savings from the merger with Bank of Santa Clarita; changes in general economic and financial market conditions, either nationally or locally, in areas in which the Company conducts its operations; changes in interest rates; continuing consolidation in the financial services industry; new litigation or changes in existing litigation; increased competitive challenges and expanding product and pricing pressures among financial institutions; legislation or regulatory changes which adversely affect the Company’s operations or business; loss of key personnel; and changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other regulatory agencies.

The Company undertakes no obligation to publicly revise these forward-looking statements to reflect subsequent events or circumstances.

Click sheet for larger image