Second Quarter 2019 Highlights

•Enhanced market presence in Los Angeles, Orange and Riverside counties, including the addition of seasoned, relationship-focus bankers

•2019 loan growth slows, despite new production, primarily driven by higher loan prepayments and real estate secured loan payoffs

•Repositioning of deposit portfolio focused on lower cost and noninterest-bearing core deposits

•Year over year comparisons are affected by the acquisition of Americas United Bank (“AUB”) on July 31, 2018.

San Diego, July 24, 2019 – Bank of Southern California, N.A. (OTC Pink: BCAL) today reported results for the second quarter ended June 30, 2019. Total assets were $767 million for the second quarter of 2019, a 47% increase compared to the second quarter of 2018. Quarterly net income increased 20% to $1.57 million compared to $1.31 million in Q2 of 2018. Total loans ended the quarter at $623 million and total deposits were $632 million.

Nathan Rogge, President and CEO of Bank of Southern California said, “We remain focused on executing our strategy, achieving long-term growth and supporting Southern California’s business community. During the second quarter, we expanded in Orange County with the opening of a regional office and full-service banking center in the City of Orange.”

“This strategic commitment to the region is further supported through the hiring of several relationship-focused Bankers in key markets in Southern California, including Los Angeles, Orange, and Riverside counties. The Bank has built a strong foundation to support its efforts to become a leading community business bank in Southern California, and is well-positioned for growth,” concluded Rogge.

The Bank continues to emphasize core banking products and services while delivering upon an enhanced customer experience. Organic noninterest-bearing demand deposit growth increased $6.8 million during the quarter, and a $20.3 million increase since December 2018. John Farkash, Chairman of the Board said, “Overall, the Bank reported meaningful results for the second quarter. The Bank continues to have a strong and well-capitalized balance sheet positioning the Bank to deliver greater value to our shareholders and achieving long-term growth.”

Additional Financial Highlights

• Total Loans declined $5 million during the quarter to $623 million at quarter end, primarily driven by higher loan prepayments and real estate secured loan payoffs. Total loans paid were $32 million during Q2 2019, and total $62 million year-to-date. Despite the decline in loans outstanding, new C&I loan commitments increased $17 million year-to-date, from $160 million at December 31, 2018 to $177 million at June 30, 2019.

• The Bank has been focused on repositioning its deposit portfolio mix toward more core deposits. While total deposits have been flat since December 2018, noninterest-bearing deposits have grown by 12%, offset by a decline of 12% in more costly time deposits. The Bank will continue to reposition and improve the deposit portfolio with the longer-term goal of protecting net interest margin.

• Nonperforming assets were 0.27% of total assets at June 30, 2019, compared to 0.60% at December 31, 2018. The allowance for loan losses (ALLL) was 0.78% of total loans at June 30, 2019, up from 0.69% at December 31, 2018. When including $2.2 million in loan fair value credit marks (LFVCM), the ALLL and LFVCM represent 1.14% of total loans versus 1.10% at December 31, 2018.

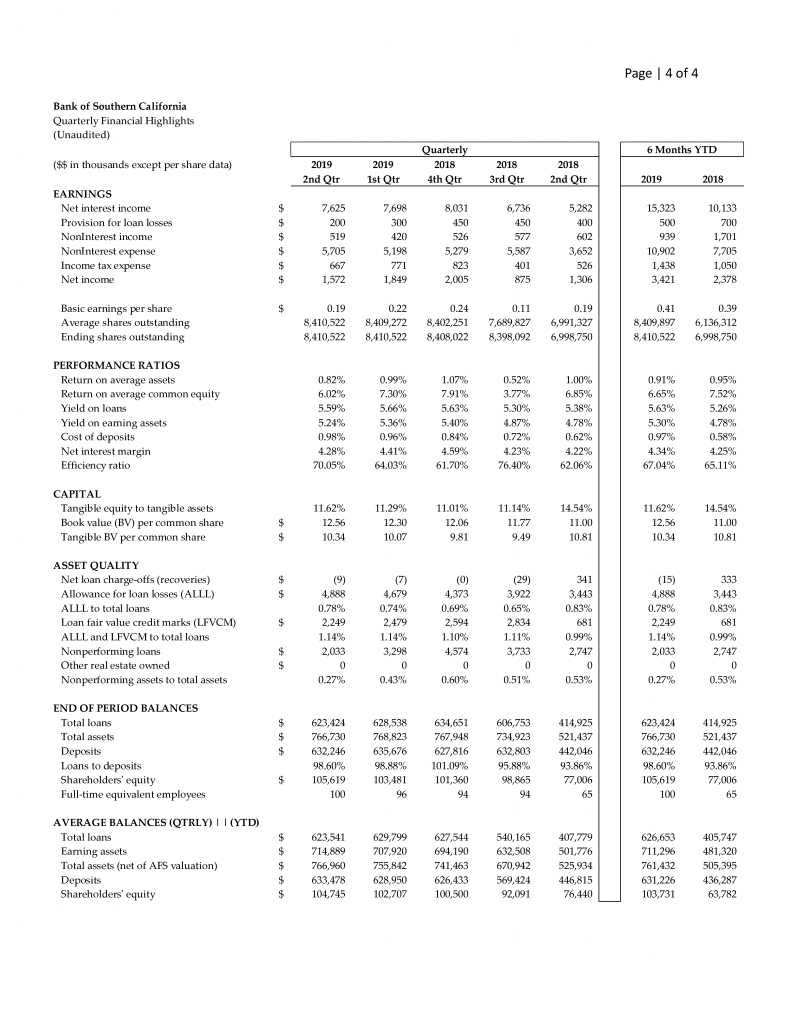

[Quarterly Financial Highlights Table Follows]

More details about our quarterly results are available on our website and through the following link to our most recent quarterly results and trends: https://www.banksocal.com/about-us/financials.